Human nature creates crises: the safer, smoother, more stable things are, the more risk people will take, sooner or later wrecking all that stability. Despite the outpouring of analyses of the 2008 Financial Crisis, it remains unlikely that society has internalized this lesson about the ever-present threat of human nature even as regards economic crises, however obvious the message may be. How much less likely is it that we are anywhere close to protecting ourselves from self-inflicted political crises?

We all are now aware that the shortsighted, selfish behavior of a few millionaires on Wall Street, a few politicians, some compliant regulators, and--truth be told--more than a few of the "other 99%" looking to cheat their neighbors for a quick buck can combine to generate a financial tsunami. It's not about foreigners. We are our own worst enemy. What most complacent and confused Americans fail to understand is the degree to which we make our own international political crises as well. From the American War in Vietnam to the Global War on Terror to the looming war against Iran (backed by Russia, China, and maybe Pakistan), the U.S. has the power to take the initiative and create these disasters but lacks the power to resolve them in a beneficial manner.

Note clearly that this discussion concerns “self-inflicted crises,” those resulting from the

conscious choice to engage in unnecessarily greedy behavior. A crisis caused by

an external force, human or natural, lies outside the discussion. Here the concern

is on a class of crisis caused by perfectly avoidable human greed leading to

obviously risky behavior (in effect, investing in a chain letter). To put it

differently, the class of crises of interest here is a class for which one

should expect the guilty to be named and punished (both by the judicial system

for crime and by God for their sins).

Since everyone is now thinking about utterly unnecessary and

egregiously man-made financial crises even as we are hit by repeated utterly

unnecessary and egregiously man-made political crises, a question that seems

timely and useful flows from the above paragraphs:

Can our recently learned lessons about financial crises help us to avoid political crises?

In The Black Swan, Taleb reports an alleged pattern of economic

risk-taking:

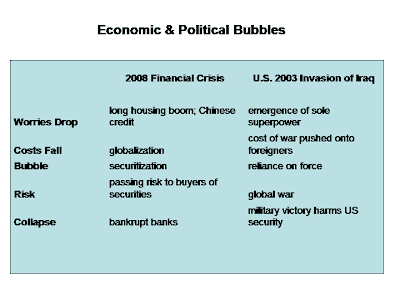

The economist Hyman Minsky sees the cycles of risk taking in the economy as following a pattern: stability and absence of crises encourage risk taking, complacency, and lowered awareness of the possibility of problems. [78.]

Nouriel Roubini, the economics professor who predicted the

2008 Financial Crisis in brilliant detail, described the “vicious cycle” of economic crises as consisting

of [once I delete the economic adjectives] the following steps [Nouriel Roubini

and Stephen Mihm, Crisis Economics 18.]:

- Worries drop;

- Costs fall;

- The bubble drives growth;

- Increasingly risky ventures are undertaken.

Applying this abstract vicious cycle (to which I would

simple add the obvious final step—collapse, i.e., the point at which the cycle ends...with a bang) derived

from economics to international relations is suggestive. Whether in economics

or politics, the dynamics of the bubble of greed are frequently equivalent. In

the aftermath of 2008, the point as regards economics must be obvious to all,

whether they have read Marx, Keynes, Minsky, and Roubini or not. Every poor, naïve, uneducated (or just greedy)

homeowner who took out a mortgage that he or she obviously could not afford and

has now lost that home is today an expert in bubble economics and the danger to

us all posed by unregulated capitalism.

But international politics is harder to see clearly through

the fog of greedy politicians who classify information to prevent the voters

from learning the truth and who wave the bloody shirt of foreign “menace” to promote their careers. Language too helps to

obfuscate. We do not talk of “imperialist

bubbles.” But if one abstracts to clear

away the clutter of detail, the dynamics of greed, willful denial, moral

hazard, and willingness to risk—even

promote—“collateral damage” in so-called Global War on Terror

looks like nothing so much as the 2008 Financial Crisis. Leaders became

increasingly confident that they could not be stopped, with their appetites for

new victories, new wealth, and new power rising apace. As the new policy—be it the issuance of new

securities based on sub-prime mortgages or military adventures in yet another

Muslim society—proceeded without

major defeat, each new venture seemed less and less costly. Every small gain

was used to justify a larger gain, every small risk to justify a larger risk.

Even when the risks were seen, they were dismissed; after all, it was the poor

who would suffer from unemployment and foreclosure…or death on the battlefields of Iraq

and Afghanistan,

and in the case of the wars, most of those poor were foreigners. Moreover, like

the Wall Street firms bailed out by politicians generous with taxpayer funds,

the White House was “too big to fail.” Like Wall Street megabanks, the White House knew it and took advantage of it: moral hazard gone wild. Like big bank CEOs, presidents

and vice presidents are almost never held criminally accountable in court for

their sins. And then suddenly, the financial/imperial party was over, and the

victims were left to clean up the mess.

In the abstract the pattern of failure is clear: failure of the people to carry out their democratic responsibility to monitor their leaders, arrogance, abuse of power, denial about the risks, corruption, lack of concern about collateral damage, and moral hazard.

In the abstract the pattern of failure is clear: failure of the people to carry out their democratic responsibility to monitor their leaders, arrogance, abuse of power, denial about the risks, corruption, lack of concern about collateral damage, and moral hazard.

No comments:

Post a Comment